From industry to industry, no matter the size or age of a company, they all have something in common. They all find it useful to know day-to-day what is working capital. Working capital is simple to calculate but its implications are huge. It is a number closely investigated by management, potential, and current investors, internal and external auditors and lenders or creditors.

What is working capital? It is the money available to a company for day-to-day operations. But why is it important? And what does it mean? Today, you will learn that and more.

What Is Working Capital?

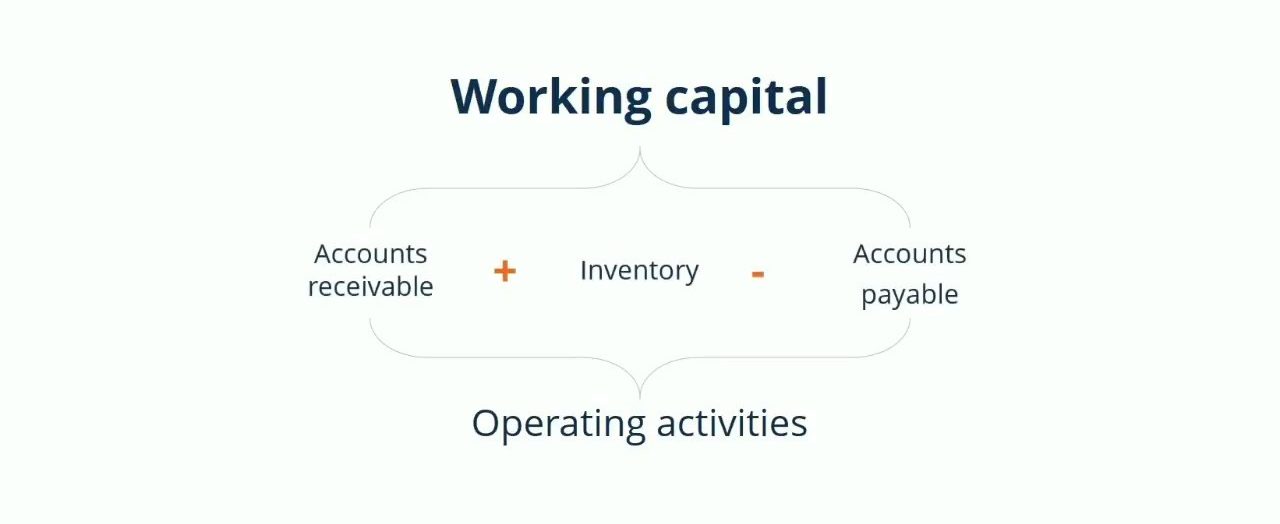

The formula for working capital is current assets – current liabilities. A current asset is cash and any other assets which are expected to be converted into cash within a year. This includes inventory, accounts receivable and marketable securities. A current liability is the amount of a liability due to be paid to creditors or vendors within a year. This includes accounts payable, accrued expenses, sales tax payable, notes payable and the current portion of long-term debt. To find the working capital, sum all current liability balances from the balance sheet then subtract this total from the sum of all current assets.

Assets

Company assets consist of any items of economic value owned or controlled by the company. They can provide either immediate or future benefits. They can also include costs a company has paid in advances such as prepaid property taxes, prepaid property insurance and more.

Liabilities

Company liabilities are any financial obligations or debt a company is responsible for due to its operations. Many liabilities include the word “payable” in their account title on the balance sheet. Examples include notes payable, accounts payable, salaries payable, wages payable and income taxes payable. It is common for nonprofits to have a suspense account classified as a liability.

You may have a synagogue collect donations for Jewish Charities, but it is designated to go to relief from Hurricane Sandy in New York. That money does not belong to the temple even though it is reflected in its bank balance, so it is accounted for in this liability account by debiting cash and crediting the suspense account. Record a debit to suspense and a credit to accounts payable to relieve the liability of the cash to be transited out. When you pay the bill, credit cash and debit accounts payable relieving that liability.

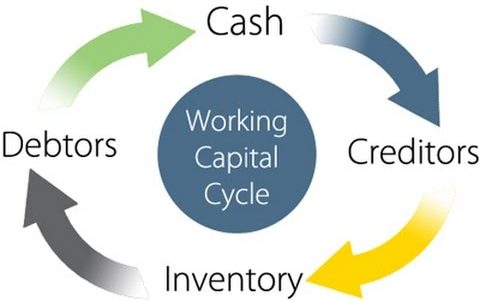

Inventory is one of the most important pieces of working capital. The longer an item sits in a warehouse or on a shelf, the longer a company’s working capital is tied up. What is working capital needs to be managed carefully to avoid situations where a company grows themselves out of business. This occurs when a company pays cash for everything rather than financing and spreading out cash payments over time. They may find themselves earning a profit on the sales they make but not generating enough sales to fulfill their expansion plans.

What is working capital does not tell an entirely accurate story. It assumes all receivables will be collected; all inventory will be sold, etc. This simply just does not happen. Even if you turn over your inventory four times a year, you still have to leverage assets such as cash to replenish your inventory. You can have several thousand dollars in receivables, but customers can write you bad checks or give you overdrawn account information causing you penalties and fees with your bank and twelve months from now you still have not completed collected on your receivables account.

Why Is Working Capital Important?

What is working capital’s importance? The importance of working capital is a picture of a company’s overall financial health, efficiency, and liquidity. As it includes cash, inventory, accounts receivable, accounts payable, the portion of long-term debt due within twelve months and other short-term accounts, it reflects a company’s ability to pay back its short-term debts nearly immediately. Analysts use it to tell them a story about payments to suppliers, revenue collection, debt management, and inventory management.

If a company has a negative working capital, it could indicate it is over-leveraged and will struggle to pay back its short-term debt from month-to-month. The company’s sales may be stagnant or decreasing, so management will have to talk to the sales, marketing, and advertising teams to remedy this. The company may have tried to pay its bills too quickly and ended up strapped for cash. A company may have plenty of sales but be collecting receivables too slowly. This is an issue for customer service representatives, customer finance representatives, and the accounts receivable department.

It is usually not useful to sell uncollected receivables off to an outsourcing company such as Atwell Curtis & Brooks. It is usually better to put into place better procedures for selling on credit. A company may choose to charge interest and late fees for customers who do not pay within the terms agreed. Alternatively, if a customer has a history of late payments, a company may choose to not effectively finance a customer’s purchase but instead require they pay cash upfront if they want to continue receiving goods or services.

Working capital provides the opportunity to find important numbers such as the inventory-turnover ratio, the receivables ratio, days payable and more.

Examples of Working Capital

It is important to understand that working capital needs will vary based on the size of a company, how it is leveraged, its expansion plans and the industry it is in. Understand the timing of asset purchases as this is not included in budget reports as it does not touch the Income Statement. Understand the payment and collection policies, the likelihood that a company will write off a bad debt and capital-raising plans for the coming year. Let’s take a look at what you can do once you know the pieces of working capital.

What Is Working Capital: Example

A company’s current assets total $250,000. Its current liabilities total $180,000. Working capital is the $250,000-180,000 or $70,000.

Working Capital Ratio (Current Ratio)

To find the current ratio, divide the current assets by the current liabilities. In the above case, you get $250,000/180,000 or 1.389. Ideally, a company will have a ratio of between 1 and 2. A ratio of less than 1 indicates they are over-leveraged and have more current liabilities than current assets. A ratio of above 2 indicates a company may have an excess of inventory sitting on shelves or is not investing its cash in profitable business ventures.

It is important to note that a company can operate successfully with negative working capital. Take, for example, the wholesale giant Costco. They finance the purchase of their inventory and then sell them to customers before the loan is due. The company’s assets are lower than other retailers because they essentially have no inventory.

Quick Ratio

This is a more accurate measurement of financial health as it removes inventory from the equation. Sum cash, marketable securities and accounts receivable and then divide that amount by current liabilities. Otherwise, subtract inventory from current assets and then divide by current liabilities. It is also known as the acid-test ratio and reflects the fact that inventory is often purchased on credit or sits in storage for periods of time.

Assume the company in the above examples have $80,000 in inventory. Using the formula, ($250,000-80,000)/$180,000, you get a quick ratio of 0.94. This indicates if a company struggles to collect cash for inventory they may struggle with solvency and end up past due on bills.

The downside to this and many other measures of liquidity is that it does not take cash flow into account. A company with a quick ratio of less than 1 can still pay all its bills on time if they turn over their inventory. A company with a quick ratio of greater than 1 may fail to pay all of its bills on time if it cannot collect all of its receivables in a timely fashion.

Conclusion

Working capital refers to the amount of money a company has for day-to-day operations. It indicates the likelihood a company can pay its short-term debts on time. Investors, management and auditors look at it to help them determine a company’s overall financial health, liquidity, and efficiency. A positive working capital indicates a company can successfully collect receivables, turn over inventory and afford its debt.

More useful than what is working capital is using the number to analyze various parts of a company’s financial health. Working capital is used to calculate ratios such as the inventory-turnover ratio, the receivables ratio, days payable and more. The current ratio, also known as the working capital ratio, is found by dividing total current assets by total current liabilities. A current ratio of less than one indicates a company may struggle to pay off its short-term debt within twelve months depending on cash flow including the sale of assets, inventory turn-over and repurchase, cash sales made and bad debt written off.

The ideal working capital ratio in most industries is between 1 and 2 meaning the company should not struggle to pay bills and is investing excess cash, paying it out as dividends or pre-paying debt with it. The quick ratio is a more accurate measurement of financial health as it removes inventory from current assets. This is useful because even when a company turns over inventory, it may be sold on credit. Thus, a company may still not have the cash to pay its debt. All in all, what is working capital is a useful tool for analyzing a company you might want to invest in.